Investment & Loan Cheat Sheet

Types of Investments

Few things in life are as important as understanding your personal finances. For someone who is not business savvy, the numbers can be a real headache. However, it is important to understand the potential risks and benefits of investing securing a loan, and even who owns your bank deposits – your livelihood may depend on it.

Seeking the advice of financial experts is always wise, when making the decision on which investment to choose. It is important that you become knowledgeable and determine your individual risk tolerance, investment strategies and personal goals before investing.

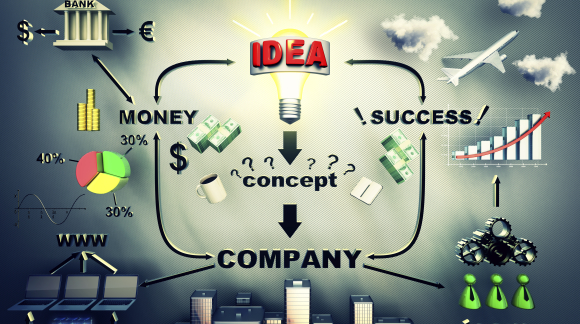

An investment is allowing capital (money) to gain profitable returns. There are many different types of investments:

- Savings Accounts – These accounts usually earn between .5 and 3 percent interest depending on the type of bank account (money market, simple, passbook).

- Stock – Stock is purchasing part of a company, which allows you to reap the benefits and bear the risks as the company succeeds or fails.

- Certifications of Deposit (CDs) – CD’s allow you to lend the bank money for a certain period of time and the bank agrees to pay it back to you with interest.

- Mutual Funds – Mutual funds are an arrangement of stocks, bonds and cash managed by a professional that you can buy into. They are somewhat like stocks, but instead of buying part of a company, you are purchasing part of an investment portfolio.

- Bonds – Bond money usually goes to the government. When the bond matures, you get the original money back with the interest earned.

Investment Tips for Beginners

When creating an investment portfolio, it is important to keep your options varied. For example, don’t invest your money solely in stocks. Instead, invest in stocks, mutual funds and a variety of investment vehicles.

Here are five basic investment tips:

- Consider the taxes – The profit you make from interest is taxable.

- Control risk – The easiest way to control risk is by investing your money in different places.

- Be flexible – Your investments will experience good days and bad days, just like the market.

- Give it time – Often, the best investment profits come from those that had time to mature and grow. Don’t move your money at the first sign of risk or loss.

- Follow your gut – If it seems like it is too easy to make a profit, it probably is.

Common Investment Terms

Below is a list of common terms relating to investments:

- Coupon – the interest rate for the bond

- Principal Value – the amount of money you will receive when the bond matures

- Maturity – the length of time until the principal value is received

- Annual report – a document showing the financial results for the last fiscal year

- Bear Market – term used to describe the market when it has been down for two or more quarters

- Bull Market – term used to describe the market when it has been up for two or more quarters

- Blue Chip – a term for stocks that are prime (usually large companies like Apple or GM)

- Dividends – profits paid to shareholders

Types of Loans

A loan allows you to borrow money from a bank or other entity and pay back a predetermined amount on a regular basis at a set or variable interest rate. Loans give you the opportunity to purchase the goods or services you need now, and pay for them later.

Popular types of loans include:

- Mortgage Loans – Funds that are borrowed from the bank in order to purchase your home. The funds are borrowed against your home, so foreclosure is a risk if you cannot make payments on time.

- Student Loans – Commonly offered by private lenders or the federal government, student loans help cover the cost of higher education.

- Business Loans – Help businessmen and women grow or create a business.

- Personal Loans – Can be used for personal expenses without a designated purpose, like paying off debt to a family member or friend or consolidating credit.

Important Considerations

The thought of securing the cash you need now is tempting, but when applying for a loan, be sure to fully consider your options:

- Timing – How long will it take you to pay off the loan? A loan calculator can help you determine a timeline.

- Interest rates – Apply the interest rate to the estimated amount of time it will take you to pay off the loan. Is it a good investment?

- Monthly payments – Be sure to understand the monthly payments and have a plan for where that money is going to come from.

Common Loan Terms

Below is a list of common terms that are used when discussing loans:

- Fixed Rate – a loan with a fixed rate means the interest will not change

- Variable Rate – a loan with a variable rate means the interest can change

- Term – the duration of the loan (usually the amount of payments you have to make before the debt is paid in full)

- Default – when you fail to repay your loan to the lenders, per the original agreement

- Loan Principal – the amount of money borrowed

- Prepayment – payments that are made in advance of the amount due

- Servicer – a company that collects payment on the loan and often offers customer service information

The NEW Banking Rules

There is one other type of investment consumers need to consider now under the Frank Dodd Rule.It involves determining who owns your bank deposits.

Under the Frank Dodd Rule, as of January 2015, with the change in banking regulation and new Capital Controls coming into play under the new Basel III tried capital requirements, the bank now owns the money you deposit.

This is why banks now ask a series of questions:

- “Why are you withdrawing today?”

- “What are you using that money for?”

All deposits are now considered an investment in the bank and there are limits on wire transfers, etc.

Under the new Capital Controls, and regulations, all banks are now required to have a plan in place for a quick shutdown if they run out of money. See: The Dodd-Frank Act, by cnbc.com for more information.

In the FDIC Annual Report 2013 – Message From the Chairman (page 7) it states “The strategy is designed to diminish contagion effects while removing culpable management and imposing losses on shareholders and unsecured creditors [depositors] without imposing costs on taxpayers.” The famous “Bail-In.”

In a paper for the International Bank of Settlements titled “Federal Register Notice on the Single Point of Entry (SPOE) Critical Reflections on Bank Bail-ins,”by Charles Goodhart and Emilios Avgouleas they state, “The bail-in tool involves replacing the implicit public guarantee, on which fractional reserve banking has operated, with a system of private penalties.”

The FDIC 2013 chairman’s message goes on to say when a bank is “to-big-to-fail” bankruptcy is not the answer.

“When bankruptcy is not a viable option and a resolution under the bankruptcy process would pose a systemic risk to the U.S. financial system and economy, the Title II Orderly Liquidation Authority (OLA) of the Dodd-Frank Act provides broad new back-up authorities to place any systemically important financial institution into an FDIC receivership.”

Charles Goodhart and Emilios Avgouleas also state, “In these new schemes, apart from the shareholders, the losses of bank failure are to be borne by ex ante (or ex post) funded resolution funds, financed by industry levies, and certain classes of bank creditors [depositors] whose fixed debt claims [money deposits] on the bank will be converted to equity [stock certificates in the new bank], thereby restoring the equity buffer needed for on-going bank operation….” “….Turning unsecured debt into bail-in-able debt should incentivize creditors [depositors] to resume a monitoring function, thereby helping to restore market discipline.”

The how of it is explained on pages 3 and 4, items 15 and 16 in a joint paper by the Federal Deposit Insurance Corporation and the Bank of England on December, 10 2012 titled “Resolving Globally Active, Systemically Important, Financial Institutions.”

Yes, the FDIC insures deposits up to $250,000, but the FDIC has far less money in its fund than it has insured deposits. The burden now is squarely on the investors (depositors) shoulders to monitor each individual bank’s liquidity, and CAMLE Rating for financial safety and soundness so not to be caught in a “Bail-In” situation.

Ancient Wisdom says: “Through wisdom is a house built; and by understanding it is established: And by knowledge shall the chambers be filled with all precious and pleasant riches.” Proverbs 24:3-4KJB

Additional Resources

- Financial Ratios you Need to Know When Buying a Business, by Tyrone Solee

- Financial Ratios Warren Buffett Uses When Analyzing Companies, by Millionaire Investor Program

- Analyze Investments Quickly With Ratios, by Jonas Elmerraji

- CAMELS RATINGS; What They Mean and Why They Matter, by schiffhardin.com

- Using CAMELS Ratings to Monitor Bank Conditions, by frbsf.org

Videos

- 5 Financial Ratio Analysis, by Matrix on Board

- Financial Ratio Analysis Tutorial Part 1: Introduction, Liquidity Ratios the Current Ratio, by Surfwtw

- Analysis of Financial Statements, by IIMT S FZE

- How to Get New Business Loans… How to Get Startup Business Loans, by Ty Crandall

- Differences Between FHA , VA, CONVENTIONAL , USDA Mortgage Loans, by Zero Down California

- Loan Modification Secrets Banks Won’t Tell You…, by Todd Rooker

- How to Pay Off a Mortgage Quickly, by Dave Ramesy – Jane Kingsley

- Investing Basics – Types of investments – Beginner Info, by 2SeriesShow

Education

- Power Trading Workshop, by tradingacademy.com

- Investing Basics, by investor.gov

Books

- Annual Statement Studies: Financial Ratio Benchmarks 0212-2013, by RMA

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions, by Joshua Rosenbaum and Joshua Pearl

- Entrepreneurial Finance: A Global Perspective, by Gary E. (Eugene) Gibbons

Apps

- On Investing, by The Charles Schwab Corporation, available on iTunes for free

- The Empire Podcast – Buying and Selling Websites/Investing in Online Assets and Businesses, by Justin Cooke and Joe Magnotti, available on iTunes for free